reports

Tax benefit associated with PHE

The Spanish Constitution establishes that public authorities must guarantee the conservation of historical, cultural and artistic heritage and promote its enrichment. For its part, our tax system has proven to be an ideal instrument to contribute to the fulfillment of these objectives, since, as is known, taxes can assume certain extra-fiscal purposes. Through a series of tax benefits from different taxes, the legislator has granted indirect promotion measures to the owners of assets that are part of the Spanish historical heritage (PHE).

An example is the exemption from property tax (IBI) for those owners of properties belonging to the PHE that enjoy maximum protection, that is, properties that are declared of cultural interest and registered in the general register of properties of cultural interest. A different question is from when this exemption applies.

Another tax benefit that we find is related to the heritage tax (IP), an important tax given the not inconsiderable economic value that many of these assets usually achieve. Specifically, assets that are part of the PHE, registered in the General Register of Cultural Interest Assets or the General Inventory of Movable Assets, as well as assets classified as assets of cultural interest by the Ministry of Culture and registered in the corresponding register, are exempt from IP. Or archaeological areas or historical sites that meet certain conditions.

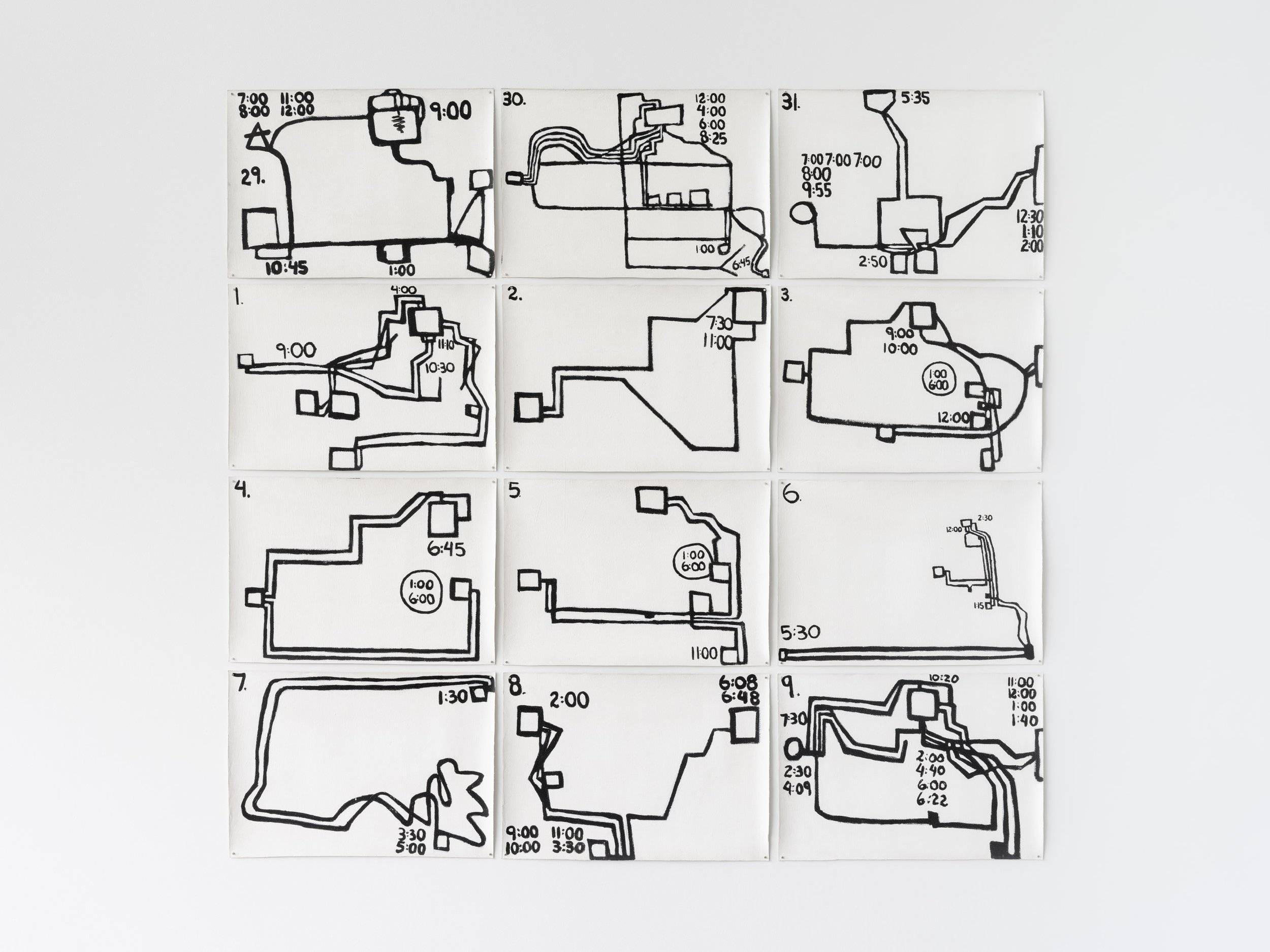

'Souvenir [Onyx]', Lúa Coderch (2016)

'Souvenir [Onyx]', Lúa Coderch (2016)

We continue with other benefits for actions for the protection and dissemination of cultural assets, such as the case of state deductions from income tax for expenses for conservation, repair, restoration, dissemination and exhibition of PHE assets declared assets of cultural interest. In this case, taxpayers are granted two deductions in the full amount linked to the expenses incurred by the owner of said assets. The first deduction is applied to the share of the amount of investments or expenses made by the owner during the tax period subject to a maximum limit and provided that the requirements established in state and autonomous community regulations are met. And the second deduction is applied for the rehabilitation of buildings, the maintenance and repair of roofs and facades, as well as the improvement of infrastructure owned by the taxpayer, with the same deduction base as the previous one.

On the other hand, and to encourage patronage, seeking economic collaboration from civil society in conservation and protection tasks of the PHE, a series of deductions from the full amount of the IRPF and corporate tax are provided for the making of monetary donations to finance these actions and provided that they are made in favor of the entities considered beneficiaries of the patronage. In addition, there are other state deductions in the taxation of income for acquisitions of certain PHE assets, as well as reductions in the taxable base of inheritance and donation tax. In this regard, inheritance tax establishes a reduction for cases of mortis causa acquisitions of PHE assets subject to compliance with certain kinship requirements, which benefit from exemption from IP and temporary ones. This provision is similar to that applied by donation tax.

Finally, the commonly called patronage law provides for two types of tax benefits for cases of donations or irrevocable, pure and simple donations of PHE assets in favor of the entities defined as beneficiaries of the patronage: on the one hand, a deduction of part of the value of the donated asset from the full amount of Personal Income Tax or corporation tax and, on the other hand, a total exemption of the capital gains revealed on the occasion of these donations to the Personal Income Tax is established as a complementary tax benefit to the donation of PHE assets.

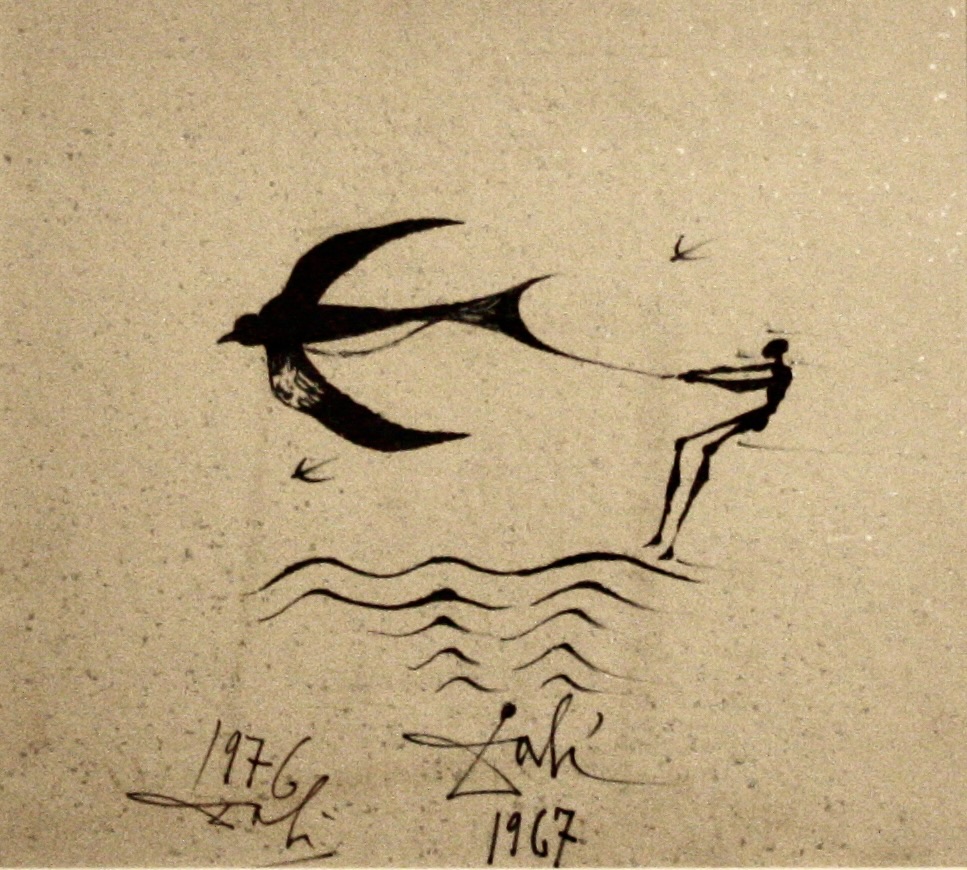

'Mini twisted man II', Cesc Abad (2023)

'Mini twisted man II', Cesc Abad (2023)